Cyber insurance protects businesses against 3rd party liability losses arising from privacy and network security liability claims, which can also include coverage for media liability claims. It can also cover costly 1st party expenses, such as business interruption, crisis management, and customer notification costs.

Cyber liability can include these core coverages:

Privacy liability protects business data, network, and client information from a breach resulting from, but not limited to, hacking, virus transmission, physical or electronic data theft, or a network shutdown.

CASE STUDIES

A healthcare company stores approximately 10,000 records on their network. The network is hacked and and the losses from the comprimised records may range from $100-$200 per record!

A healthcare company stores approximately 10,000 records on their network. The network is hacked and and the losses from the comprimised records may range from $100-$200 per record!

Solution: Cyber liability coverage would not only pay for lawsuits and legal expenses arising out of a data breach, but it would cover costly notification expenses, including HIPAA notification requirements.

A restaurant finds out that one of its waiters has stolen credit card and identification information from customers, and made charges on the accounts.

As a result, the owners of the restaurant are concerned the damaged reputation will lead to revenue loss.

As a result, the owners of the restaurant are concerned the damaged reputation will lead to revenue loss.

Solution: Cyber liability coverage will pay for lawsuits and legal fees resulting from their customers compromised privacy rights.

In addition to the liability coverage, this policy will also pay for call centers, credit monitoring, forensic fees, and consulting to help their customers and restore the restaurants reputation.

INDUSTRIES

- Law, Financial Services, Healthcare

- Retail, Restaurants, Hospitality

- Non-profit, Education, Manufacturing

- Tech, Media, Communications

…in summary, every business sector!

CASE STUDIES

An employee mistakenly posts an inappropriate message on the company website or social media page which defames a competitor. The competitor sues the company for defamation.

Solution: Media liability will pay for lawsuits and legal fees arising from libel or defamation via email, blogging, or other internet activities.

Company A designs a website which is similar to some of its competitors. Company B sues company A for infringing on their website design. Company A knows it did not steal any of its competitor’s intellectual property. However, company A incurs substantial legal fees from this event.

An employee mistakenly posts an inappropriate message on the company website or social media page which defames a competitor. The competitor sues the company for defamation.

Solution: Media liability will pay for lawsuits and legal fees arising from libel or defamation via email, blogging, or other internet activities.

Company A designs a website which is similar to some of its competitors. Company B sues company A for infringing on their website design. Company A knows it did not steal any of its competitor’s intellectual property. However, company A incurs substantial legal fees from this event.

Solution: Media liability will defend your business from claims arising out of copyright, infringement, or plagiarism.

Copyright infringement and plagiarism online are growing as a result of greater internet usage. Even if the claim is dismissed, the legal fees and additional expenses can be financially burdensome.

Solution: Media liability will defend your business from claims arising out of copyright, infringement, or plagiarism.

Copyright infringement and plagiarism online are growing as a result of greater internet usage. Even if the claim is dismissed, the legal fees and additional expenses can be financially burdensome.

INDUSTRIES

- E-commerce

- Restaurants

- Retailers

- Healthcare

- Law

- Finance

Breach notification expenses

Austere government regulations for network breach remediation, including costs to notify all customers of possible identity or credit card theft, can be expensive and time consuming.

Loss of business income

Damage to your network or loss of valuable data can disrupt business continuity and operations resulting in a substantial loss in revenue.

Data and network restoration

Damage to your network or loss of valuable data can disrupt business continuity and operations resulting in a substantial loss in revenue.

Electronic Theft

A network breach may result in electronic theft in which company money or securities are stolen. Electronic theft coverage can reimburse your company for fraudulent transfer of electronic funds.

Crisis management for call centers, credit monitoring, forensic fees, & consulting

Following a network breach, businesses face the arduous task of providing prompt customer support and credit monitoring, while having to simultaneously determine the root cause of the network breach itself. Crisis management coverage can provide call centers, credit monitoring, and forensic fees to help mitigate losses. Furthermore, crisis management can also include coverage for consulting to protect against public relation damages.

WHY DOES MY COMPANY NEED THIS COVERAGE?

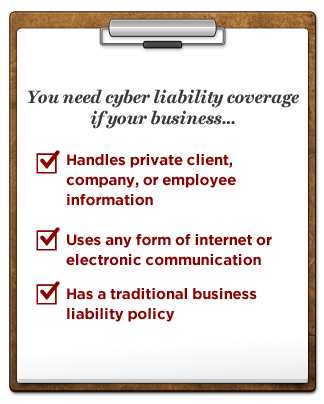

Cyber liability is necessary for businesses handling private or confidential client, company, or employee information. It is necessary for businesses using any form of internet or media communication, such as a company website, email, or internet capabilities.

Cyber liability is necessary for businesses handling private or confidential client, company, or employee information. It is necessary for businesses using any form of internet or media communication, such as a company website, email, or internet capabilities.

In other words, there is no business which can afford to be without protection from some of the most common and financially devastating risks in our technology-latent and information sensitive society.

Traditional business liability policies will not include this coverage.

Secure your business and protect your client today.

Ransomware & Cyber Extortion:

Cyber criminals use malicious software to seize network systems and confidential data causing severe disruption to business activities.

This coverage can reimburse a business for Ransomware events and provide valuable resources for handling claims.